China will extend preferential tax policies for foreign nationals working in the country through to the end of 2027, the finance ministry said on Tuesday, in a boon to foreign firms struggling to attract talent post-COVID.

The government proposed scrapping the provision of non-taxable allowances for foreign workers in 2022, but decided to extend the scheme on a review basis until the end of this year.

Foreign chambers of commerce and business organizations in China had been seeking urgent clarification on whether the government would further extend the policy that enables expatriates to benefit from taxable deductions on house rental, children’s education, language training, and other costs.

THE WAY TO TAKE ON CHINA IS TO MAKE IT PERSONAL

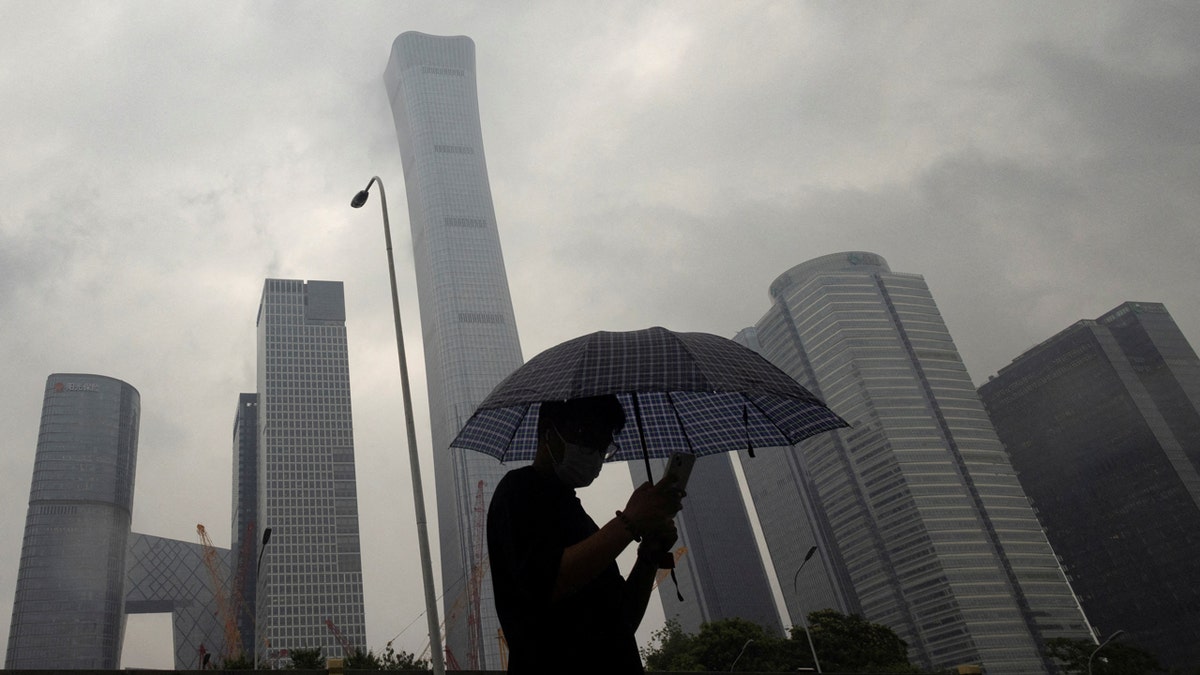

A man walks in the Central Business District on a rainy day, in Beijing, China, July 12, 2023. (REUTERS/Thomas Peter/File Photo)

“We believe that this will help to curtail further outflows of qualified international talent, while also providing multinational companies with clarity on their talent strategy regarding the deployment of expatriate staff and structuring of their packages,” said Kiran Patel, senior director at the China-Britain Business Council.

“This announcement to extend the existing individual income tax regime is a genuine statement of commitment from the Chinese government to the multinational companies operating here.”

As China’s economy slows, authorities have struggled to revive foreign investment with global firms unimpressed by new incentives they say fall far short of sweeteners once used to attract overseas money.

Read More: World News | Entertainment News | Celeb News